Frugal Living: How to Save Money Without Sacrificing Quality of Life

Introduction

Living frugally doesn’t mean living poorly. With over 30 years of experience in the finance industry, I’ve seen how intentional, smart financial choices can lead to significant savings while enhancing overall life satisfaction. This guide will help you understand how to live a frugal yet fulfilling lifestyle, focusing on strategies that prioritize both financial health and quality of life.

1. Create a Budget and Stick to It

A well-planned budget is the cornerstone of frugal living. Knowing where your money goes helps you identify unnecessary expenses and redirect funds towards savings or investments.

Actionable Tip:

Start with a simple budget by categorizing your expenses: fixed costs (rent, utilities), variable costs (groceries, gas), and discretionary spending (dining out, entertainment). Use budgeting apps like Mint or YNAB to monitor your spending in real-time and ensure you stay within your limits.

2. Plan Meals and Cook at Home

Eating out or frequently ordering takeout can quickly drain your finances. By planning meals and cooking at home, you not only save money but also enjoy healthier, more nutritious meals.

Actionable Tip:

Set aside time each week to plan your meals and create a grocery list. This approach minimizes impulse buys and ensures you only purchase what you need. Batch cooking and freezing meals can save you time and reduce the temptation of dining out.

3. Buy in Bulk and Use Coupons

Purchasing non-perishable items and household essentials in bulk can lead to substantial savings. Additionally, using coupons and taking advantage of discounts can reduce your overall expenditure.

Actionable Tip:

Identify items you use regularly and buy them in bulk from warehouse stores like Costco or Sam’s Club. Use coupon apps like Honey or RetailMeNot to find discounts and promo codes. Always compare prices to ensure you’re getting the best deal.

4. Cancel Unnecessary Subscriptions

Monthly subscriptions for services you rarely use can add up. Review your subscriptions and identify ones that are not providing sufficient value.

Actionable Tip:

Cut back on streaming services, magazine subscriptions, gym memberships, or any other recurring expenses you don’t frequently use. Use tools like Truebill to track and manage subscriptions easily.

5. Embrace DIY Projects

From home repairs to personal care, doing things yourself can save considerable amounts of money. Many resources are available to guide you through various DIY projects.

Actionable Tip:

Utilize YouTube tutorials and online courses to learn skills like home improvement, cooking new recipes, or personal grooming. Not only will you save money, but you’ll also gain new skills and a sense of achievement.

6. Shop Secondhand

Purchasing gently-used items can be a fantastic way to save money without compromising quality. Thrift stores, online marketplaces, and consignment shops offer a wide range of products at a fraction of the original price.

Actionable Tip:

Explore secondhand stores in your area for clothing, furniture, and household items. Use platforms like eBay, Facebook Marketplace, and Craigslist to find good deals online. Always inspect items for quality and be selective to ensure longevity.

7. Utilize Public Transportation

Rely on public transportation or carpooling whenever possible to reduce transportation-related expenses such as fuel, maintenance, and parking fees.

Actionable Tip:

Map out your regular routes and determine public transportation options available. Consider purchasing monthly transit passes if available, as they often offer savings compared to individual tickets. Carpooling with neighbors or colleagues can also cut costs and reduce your carbon footprint.

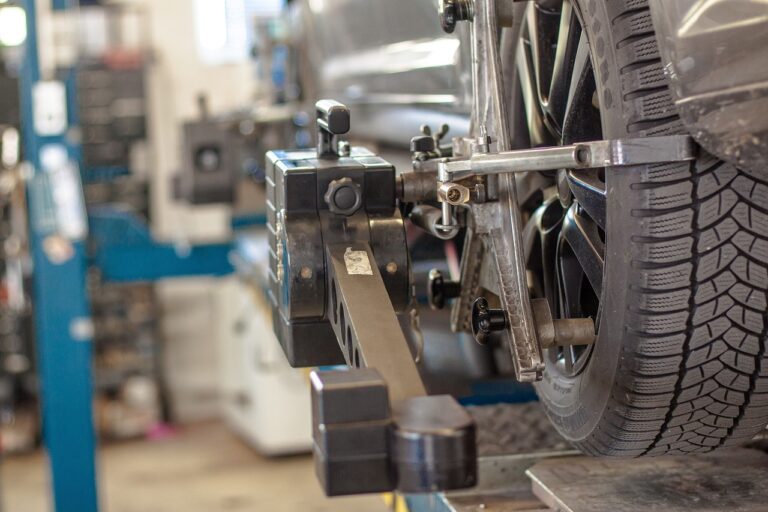

8. Implement Energy-Saving Practices

Reducing your household’s energy consumption not only lowers your utility bills but also benefits the environment. Simple changes can make a big difference over time.

Actionable Tip:

Replace incandescent bulbs with energy-efficient LED lighting. Unplug appliances when not in use, and consider installing a programmable thermostat to optimize heating and cooling. Regularly maintain your appliances to ensure they operate efficiently.

9. Find Free or Low-Cost Entertainment

Having fun doesn’t have to be expensive. Plenty of free or low-cost entertainment options can help you enjoy life without stretching your budget.

Actionable Tip:

Explore local parks, hiking trails, and community events. Take advantage of free admission days at museums or cultural institutions. Engage in hobbies like reading, crafting, or volunteering, which can be both fulfilling and inexpensive.

10. Mindful Spending and Delayed Gratification

Adopting a mindful approach to spending means making deliberate and thoughtful financial choices. Practicing delayed gratification can lead to more meaningful and intentional purchases.

Actionable Tip:

Before making a purchase, pause and ask yourself if it’s a need or a want, and evaluate whether it aligns with your long-term financial goals. Implement the 30-day rule: wait 30 days before buying non-essential items to ensure it’s a thoroughly considered decision.

Conclusion

Adopting frugal living doesn’t mean sacrificing your quality of life; instead, it’s about making smarter financial choices that provide both immediate savings and long-term benefits. By creating a realistic budget, cooking at home, embracing DIY projects, and utilizing secondhand markets and public transportation, you can enjoy a high-quality lifestyle while saving money.

Start implementing these tips today to take control of your finances and enhance your overall well-being. Remember, frugal living is about value and sustainability, making thoughtful decisions that benefit your wallet and lifestyle.

For more financial advice and tips on living a frugal, yet fulfilling life, explore our other articles or consult with a certified financial planner.